-

Pregnancy preparedness: Part 3- It’s a Pamper Party

Hey, Nickels! Welcome back to the 3rd installation of my pregnancy preparedness series which is all about self care. I hope you have enjoyed my first two posts Pregnancy preparedness: Financial Readiness and Pregnancy preparedness: What the health?

After learning I was pregnant I became acutely aware that my life was going to change for the better but nonetheless, forever changed. For the past 34 years I had become accustomed to leaning on myself and caring for my needs only. Becoming a parent would be a major shift in priority for me so it was important to me to honor my old self one last time. If there is one thing I am indisputably good at, it is self care. This may be attributed to my virgo nature, or maybe the fact that I am a middle child and had to self sooth, or it could be because I am single with no one to shower me with love and affection so I’ve learned to TREAT MYSELF. To commemorate my last moments of putting myself first I planned a series of events and activities during my pregnancy. Below are a list of things I did as a mom-to-be honor and pamper myself during my pregnancy.

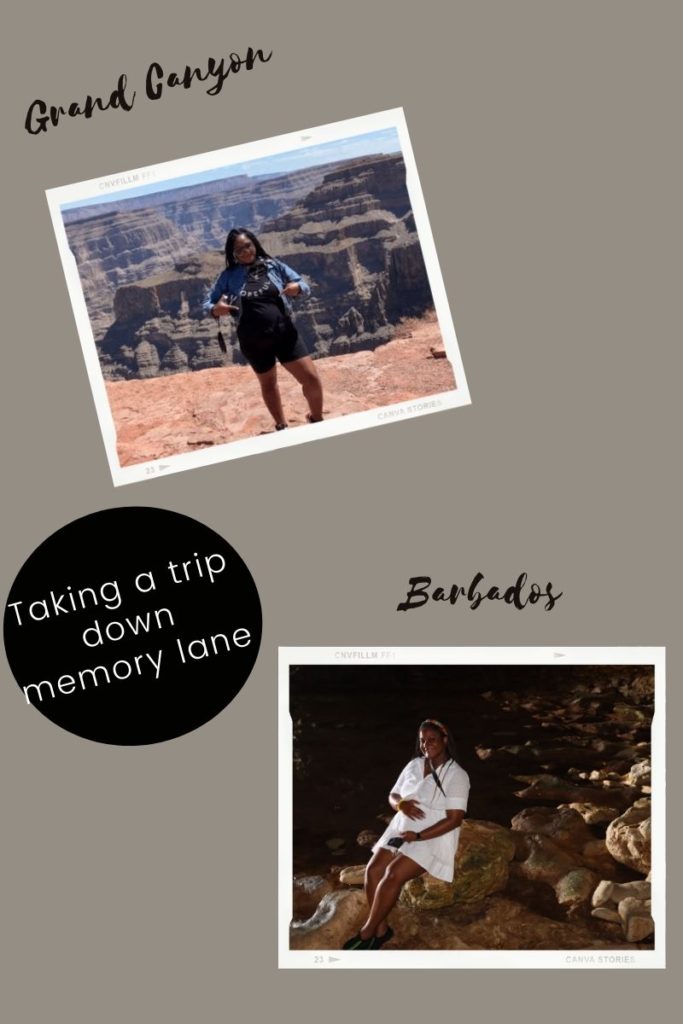

Vacationing: Of course I plan to travel the world with my son and future daughter one day but traveling with children is a lot different than traveling without them. I was a pretty solid traveler before becoming a mom so while pregnant I booked 3 trips. The first trip was an international trip to Barbados. I extended the invite to my best friend but she was unable to accompany me so I booked the trip as a solo traveler (though I was not quite solo given the fetus growing inside of me). Next, I visited the Grand Canyon which was a bucket list destination. I had planned to go on a Grand Canyon trip in 2018 while I lived in California but I moved prematurely and never got to go. I attempted to plan the trip again with one of my besties in 2019 but it got postponed until 2020 then covid hit and the world shut down along with my Grand Canyon plans. The opportunity presented itself again while I was pregnant and I was sure to book my trip without hesitation. In photos you can observe my growing baby bump if you look closely. Finally, I took myself on a baby moon which is defined as a last vacation taken by expectant parent(s) before a baby is born. I went to Hershey for the weekend where I got to make my own chocolate bar and treated myself to my first ever body scrub at the Melt Spa.

Dining out and culinary experiences: I had many culinary experiences while pregnant. I ate at a few nice restaurants that I had wanted to try. I figured higher end restaurants would be off the rotation for a while as a new mom. For instance while in Las Vegas for my Grand Canyon trip I stayed at the new Hilton at Resorts World which has over 40 food and beverage experiences. I tried several of the restaurants while there including the Marigold which is now permanently closed. At the Marigold I ordered the Vegas Lobster Roll which had Santa Barbara sea urchin, American caviar, and dill aioli. It was my first time trying caviar and to be honest had I known there was caviar on the roll I would not have order it. I must say I am happy I tried it because the lobster roll was really tasty yet pricey. Also, for my birthday I took a beach trip with my cousin where we ate at a steakhouse, Prime 13 located in Point Pleasant, NJ. This place served warm soft pretzel in lieu of bread and just wow, it was mouth watering! Also, rather than the mundane caesar salad served at most restaurants this place served a charred grilled romaine lettuce caesar salad and again, just wow! To top it off I ordered a lobster which just melted in my mouth. Another place I dined at while pregnant was Sullivan’s Steakhouse. I would drive by Sullivans while in the KOP area often and always wonder what the food was like so I finally decided to make a reservation. My cousin and I ordered all appetizers. I really enjoyed the Spicy Shrimp Eggrolls. Next, I took a cooking class with my BEST friend, Mo at Sur La Table where I learned to make 3 different types of crepes. Then of course I hit up my favorite lunch spots like Olive Garden and Red Lobster whenever I had the chance. It was not lost on me that I would lose the ability to just jump in the car and go once I became a mom. So I took every opportunity to jump in the car and take myself out.

Spa day and entertainment: Now we all know a spa day is the epitome of pampering oneself so I had to add this to the list. I won’t spend too much time on the subject because I mention my spa experience in detail in last December’s post, Gift Guide to Yourself. Essentially, while pregnant I had a pregnancy massage on my birthday at the Four Seasons Hotel and a body scrub at the Hershey Melt spa during my baby moon. Also while pregnant I hosted a pamper party with a few women from my village at a luxury nail spa. We celebrated womanhood with a nice mani/pedi combo. Again, I mention this experience in my Gift Guide to Yourself blog post. In addition to nice spa days I went to sporting events and museums. For example, my cousin and I went to the 76ers and Utah, Jazz game. The 76ers loss that night but to be fair, the Jazz were ranked 3rd overall in the league at the time so the odds were against the Sixers that night but it was an exciting game. Also, I went to WonderSpaces with my friend. This place is pretty cool, affordable, and offers plenty of great photo opportunities.

Gifts: Since having my son every dime I spend is for him. I honestly do not remember the last time I purchased something for myself. However, while pregnant there were a few purchases I made for myself like my push present. A push present is usually given by a partner to celebrate the milestone of motherhood and to thank the new mom for laboring. The gift is typically jewelry. However, as a single mom there is no partner to celebrate my milestone so I gifted myself a Tiffanys and co necklace with a note to read after labor. I was sure to pack it in my hospital bag. Next, I am obsessed with Chicago style gourmet popcorn so I definitely ordered some Garret mix, Garret’s popcorn and ate it ALL in one night. Lastly, I purchased a Christopher John Rogers dress for my birthday from one of Target’s designer collaboration sales which was a huge hit. I cannot recall ever receiving so many compliments on something I was wearing.

Naps and long showers: Sometimes it is the simple things that make us feel the most pampered. I will never forget my line sister telling me to enjoy taking naps and long showers. I can now confirm those mundane tasks like showering and sleeping are indeed luxuries with a newborn. I am glad I took naps almost EVERY lunch hour while pregnant (which I did before pregnancy too, I am napper) and relished in long showers. I rarely get to take naps now and my showers are short.

Professional development: I had always desired a career in Finance particularly helping people plan for their future so I did a lot of research to determine the best career move for myself and personal financial planning came to mind. I had started an accelerated Personal Financial Planning (PFP) program before I got pregnant but completed my program in my second trimester. It was the first step of many to begin my career as a planner and to help my family build wealth. The successful completion of the program while pregnant was so gratifying given how challenging the courses were. My professors did not think I would be able to keep with the other professionals in the class because I was the only person who was not already an agent or advisor in my cohort. As such completing the program and sometimes outperforming my classmates was an added bonuses. Upon completion of my PFP certificate I began an entrepreneur certificate program and started studying for the big exam. Some people may not consider professional development pampering but I think anything that makes me feel good is considered pampering.

Comment below and share with me how you like to pamper yourself. Do you take yourself on trips, out to eat, or treat yourself to pedicures too?

-

Pregnancy Preparedness: Part 2- What the health?

When I was family planning I knew I needed to better understand my own health metrics to understand how they may impact a pregnancy. Essentially, I wanted to confirm my body was equipped to take on the task of carrying a healthy baby to term given the high maternal mortality rate in the African American community. Here are some things I did to confirm I was physically and mentally able to have a baby.

Conventional health screening: I scheduled a basic biometric screening to check my BMI, blood pressure, and blood sugar levels.

Women’s Wellness Screening: I scheduled my annual women’s wellness check up to have a standard pap-smear performed and to discuss some basics regarding my reproductive health.

Cardio Screening: Due to a history of abnormal Electrocardiograms (EKG) I decided I needed to investigate this issue before going any further in the fertility process. I had a series of tests administered such as a stress test, a chemical stress test, and a computed tomography scan (CT scan). The first two tests were abnormal but my CT scan came back normal which ruled out heart disease.

Fertility Screening: While my OB/GYN was my first line of defense when it came to my reproductive health I knew I would need some additional assistance getting pregnant. I proceeded with scheduling initial consultations with a couple fertility clinics before settling on the one I would ultimately use on an ongoing basis. My consultation was followed up by a thorough screening which included an assessment of my hormone levels, genetic testing to screen for DNA disorders that could be potentially harm my child, an ultrasound to examine my female organs, a saline ultrasound to determine if my fibroids would impact my pregnancy, and a HSG screening to ensure there were no obstructions in any of my essential reproductive parts.

Mental Health Screening: Finally, my fertility clinic required me and all its clients to have a psychological exam done before moving forward with any treatment plan. Lucky for me I already had a mental health provider and therefore, I discussed family planning with my therapist. My doctor and I talked through various sensitive subjects such as postpartum depression and what it would mean to be a single parent.

Please comment below and let me know healthy steps you’ve taken to prepare for parenthood. Did you family plan with your healthcare provider?

-

Un-wine: how I discovered alcohol removed wine

Trying to hide a pregnancy is very hard especially when everyone’s pastime is drinking! I had to find clever ways to avoid a cocktail without looking suspicious when socializing with family and friends. This was especially true when my grandma proposed a virtual family toast to celebrate my Aunt’s graduation from Yale. I was nervous that my pregnancy would be revealed prematurely given how perceptive my family can be. For example, I once posted an unrelated encrypted message on Instagram about my blog and received a slew of inquiries from my family asking if I was going to make a pregnancy announcement. So in my quest to deceive my family I found my little fingers pitter paddling on my computer’s web browser searching for alcohol removed wines and that is when I discovered the brand FRE!

Fre, is an alcohol removed wine that still has about .05% of alcohol remaining after the removal process. My research suggest that amount of alcohol is deminis and not harmful as it is equivalent to the alcohol content found in some natural fruits. The wine looks like wine and taste like wine plus the price point is phenomenal, pricing south of $8. So if you are looking for some alcohol free ways to cheers in the new year check out the Fre wine brand!

*If pregnant please consult your doctor before consuming this product*

-

Pregnancy Preparedness: Part 1- Financial Readiness

The moment I decided that I was ready to be a parent I knew it was time to ensure my personal finances were in order. It helped that I was already enrolled in my accelerated Personal Financial Planning program at UCLA during the time of my IVF. The program kept me educated and motivated while I administered shots to abdomen each night. Below are some of the steps I took to prepare for my son.

First, I evaluated life insurance:

I happened to be enrolled in my insurance planning class at the time I decided to evaluate my life insurance coverage. Our professor, who has retired was a renowned CFP and Insurance agent in California, shout out to Linda! We literally reviewed every type of insurance there is, Disability; Life; Auto; Homeowners; Health; Long term care; Annuities; and Social Security. As a prospective planner I knew the first thing I needed to do when evaluating my life insurance needs was determine if I had any shortfall in my current coverage and there are three common calculations available to do just that. I used the multiple of salary method which is the fastest and least precise option to get a ballpark figure of what I was looking for before calling an insurance agent.

Calculation Option- Multiple of Salary Method

This method simply takes the salary of the wage earner and multiples it times the number of years the family will be able to continue as they are now in the event of the wage earner’s death. This is the least complex calculation and should really only be used to get a quick estimate. The other calculation options are the Human Life Value Method which is more precise and Personalized Needs Approach which is the most precise.Once I understood how much of a benefit I needed it was time to select a provider. I did this by confirming the credit rating and financial strength of the policy provider that I wanted to use. Then, I determined the type of policy I wanted. I started with a termed life policy which would cover my current liabilities and would extend until my son is the age of majority. Also, I added a smaller whole life policy which would accumulate a cash value. This policy would be used to cover my funeral and final expenses. Finally, I added a third policy to offer a cushion to my son’s guardian to assist with childcare expenses.

Please note, it is okay to consider your employer’s group life insurance policy when evaluating your life insurance needs. Some agents will insist that an employer’s group life policy is inconsequential but everyone’s financial circumstances varies. A planner understands that one size does not always fit all and would consider all avenues when preparing a comprehensive plan.

Next, I evaluated health insurance:

When embarking on the path to parenthood it was prudent for me to understand my health insurance benefits as I would be using them quite a bit for reoccurring doctor appointments, ultrasounds, labor and delivery. I first did an independent visual review where I analyzed my deductible and maximum out of pocket cost for the year. In understanding these cost I was able to save a reserve over my 41 week pregnancy (yes, I had a late term baby lol) to cover my medical expenses. My due date was 1/2 so I desperately wanted to have a 2021 baby as I had already paid my maximum out of pocket expenses for the year but my son had different plans; I was prepared to adapt. Next, I decided to call my providers (I was in between 2 providers in 2021) to better understand my policy’s offering. It was through these calls that I learned I would be eligible to receive a FREE BREAST PUMP! Yes, that’s right I was able to order a free electronic breast pump through my health insurance provider. I was given many options to choose from too which included the most advanced pumps on the market.

Now, it was time to Prepare an Estate plan:

With both of my employers in 2021 I opted into a group legal plan policy during open enrollment in preparation for my son’s arrival. I was sold on this legal service once I realized they offered estate planning services with my coverage. I pay approximately $9 bi-weekly for this plan and from what I understand about attorney fees, this service is a fraction of the premium I would have paid hiring an attorney on my own. My service provider’s website can populate a pretty robust estate plan in 15 minutes following the completion of a brief questionnaire. Below are the materials included in my estate plan:

- Last Will and Testament (in the event I die)

- Advance Healthcare Directive aka Living Will (in the event I am incapacitated and need someone to make health decisions)

- Durable Power of Attorney (in the event I am incapacitated and need someone to make financial decisions) and,

- Revocable Living Trust for my property

The above documents had to be notarized with 2 witness who were unrelated to me and not included in the directives. You can find a FREE notary at your local bank branch, which is what I did or local councilman’s office.

Finally, I established an emergency fund:

Here is the link to my blog post about establishing an emergency fund,

-

Things I wish I knew at 22 that I now know in 2022!

Nickels, have you seen the most recent season of Emily in Paris? The main character is a complete trainwreck but it did inspire this blog post. Emily is navigating her 20’s and like most of us during that era is making a lot of questionable decisions. It made me think of my own experiences in my 20’s to which I have identified a list of 6 things I wish I knew then that I know now. Please be sure to comment and let me know if you can relate?

1. College was a waste of time and money

Hear me out, if you are not a millennial you may not understand this sentiment. I was a first generation college graduate and felt pressure to go to school. My family, teachers, and school counselor assured me that attending college was the next logical step following high school. Their idea was that a college’s education would provide financial security and an abundance of opportunities. They were wrong but to be fair they did not know it at the time. As the saying goes “talent is equally distributed but opportunity is not”. For me, college only yielded a mediocre job earning a modest income AND wouldn’t you know I have navigated my 13 year career without ever once being asked to provide proof of my degree? So many businesses require an education but never actually request a candidate to produce evidence of that rather arbitrary requirement. In college they put so much stock into us declaring a major by our second year; I majored in Finance. However, in the real world our majors do not actually make a difference. There are so many individuals working in my field of study that majored in something else in college. I wish I would have studied something more liberal in college and later obtained my financial licenses and/or certifications. Certificates hold more stock in Finance than a degree anyway. If I knew then what I know now I would have reconsidered going to college all together or at least held off for a while. There are plenty of lucrative career options that do not require degrees and many employers who now offer tuition reimbursement programs. It maybe would have been more resourceful to gain valuable work experience and then at a later time pursue a degree while taking advantage of an employer’s reimbursement program.

2. Accepting a job just to get my foot in the door was a huge mistake

Upon graduating from college it took me 2 years to find a job. I was convinced by a recruiter to accept role in a call center at a financial institution just to get my foot in the door of that company. I was stuck at that same company for 8 years and not much beyond a toe got into that “door”. The flaw with the foot in the door action plan, particularly for an African American woman, is that once in a position we tend to be typed cast for that role. What I mean is prospective employers and recruiters are reluctant to value potential over experience. My experience happened to be in a role I never wanted in the first place and I was challenged with trying to convince prospective employers to see my potential, honor my transferrable skills, AND acknowledge my degree! While networking maybe would have alleviated some of those pain points I found it difficult to connect with decision makers on that level. Studies have shown that women and people of color have more difficulty with networking, mentorship, and sponsorship compared to their white counterparts. For instance, check out the 2012 study (performed during the early stages of my career) by Katherine Milkman, a professor at Wharton School of Business who reviewed how race and gender impacts advancement. I like to think her study further supports my theory that getting your foot in the door is not a very useful strategy for woman of color. In essence, if I knew then what I know now I would have been more aggressive and held out for the job I really wanted.

3. Dating after of college is hard!

I will never forget the time my sorority sister coined the phrase “women go to school to get their MRS” and I wish I would have known then what I know now which is dating is hard after college! Most of my friends and acquaintances who are married met their spouses in college or at college age. Dating for me in college was traumatic, full of drama, and a huge distraction. As such, I had no intention on finding a husband there; big mistake! I assumed I would have plenty of opportunities to date upon graduating following the establishment of my career but I grossly miscalculated my odds. I did not account for the challenges of meeting a quality partner outside of a controlled environment like school. Suddenly my dating pool was shallow and filled with prospects who they themselves had accessibility to an unquantifiable amount of women. In summary, dating as an adult has been daunting, filled with a lot ghosting, disappointment, and regret! Maybe I should have focused on settling down before graduating college.

4. Self love and internal validation is important

I was very insecure in my 20’s. I needed a lot of external validation from family members, friends, lovers, employers, etc. The issue with relying on others to validate my worth was running the risk of being undervalued which I often was. For example I would overextend myself at work, clocking in long hours and independently learning skills to enhance my job performance. However, I was never acknowledged for my proactiveness and tenacity. Something I know now that I wish I knew then is that validation and confidence comes from within then exudes on the outside.

5. Deal with people accordingly

I use to overvalue my relationships in my 20’s and early 30’s. No relationship should come at an unreasonable cost. In my 20’s time served in any relationship such as a friendship superseded the quality of that relationship. One thing I know now that I wish I knew then is that all relationships are going to have hurdles, there will be growing pains, and conflict inevitable but it is important to me that a friendship has certain key qualities. The key qualities are mutual respect, honest communication, and equity. It is all about balance and reciprocity for me. My sister once gave me the best advice regarding relationships that do not meet my expectation and that was to deal with people accordingly. In dealing with people accordingly I do not have to have a big blow out or kumbaya like I did when I was younger to express myself. I’ve learned that reevaluating and redefining a relationship in silence is more peaceful and effective; it is a natural evolution in every relationship’s life cycle. I think about how allocation elections in a retirement plan work. Every so often the percentages of the funds elected get off balance and a financial adviser or some automated system comes in to do a rebalancing of those investments to ensure the investor stays on track with their goals. Relationships need that same evaluation and rebalancing sometimes. As such, not all relationships can survive that process and that is okay. Sometimes you have to change the investments all together to meet the end goal.

6. Things almost never go as planned

Most of us had a plan in life which is why we went to a certain school, declared a certain major, dated a certain guy, befriended a certain group of people, moved into a certain neighborhood, etc. I do not know about most people but for me none of my plans went as planned. I was very specific about my goals and corresponding timelines but life happens while we’re planning for life, right? So something I know now that I wish I knew then is that adaptability is the key to happiness. I have accepted that in life I must pivot to survive and I now desire preparedness over having a concrete plan. So let’s toast to planning for the best but preparing for the worst.

-

-

Issa Molly?!… BFF Quiz

I know my Nickels must be huge fans of the hit HBO series, Insecure like me, right?! The series just wrapped its final season last month and I am already suffering from withdrawal. The two central characters, Issa and Molly are best friends on the show and remind me of my own quirky friendship with my BFF, JRW. In fact, I think their relationship is representative of MOST healthy BFF relationships. So today’s post is all about paying homage to our BFFs, a relationship like no other in the world! Complete the below BFF quiz to see if you have a Molly or Issa in your life.

-

In Case of Emergency

Nickels, do you have an emergency fund? This is a topic that is near and dear to my heart based on my own financial hardships and experiences. You may recall during our current VP’s run for the presidency in 2019 her mention of how most Americans were only a $500 emergency away from a complete financial catastrophe which is why this topic is so important. As a person who has studied Personal Financial Planning and has a degree in Finance I have observed that most people when discussing financial literacy or generational wealth glaze over how essential an emergency fund can be to a person’s overall financial wellness. I think most of us put the cart before the horse on this particular topic of financial planning. In class we were taught that a sufficient emergency fund is a top priority to establish with most clients before helping them assess their other financial goals because without this component their other financial goals such as retirement, insurance, and investing can be compromised.

So you may be wondering what a sufficient emergency fund is, right? Well that may vary from person to person as the rules may be applied differently based on a person’s financial well being. For example an extremely wealthy person like Elon Musk is less likely to have or need an emergency fund solely based on the characteristics of an emergency fund which are savings placed in cash or cash equivalents; not many wealthy people or savvy investors will tie up their assets in such low interest generating accounts. However, the average American needs such a fund and without curating a custom analysis on an individual which would include preparing a statement of financial positions to determine a person’s net worth and a cash flow statement to understand a person’s spending habits and non-discretionary expenses, the general answer to the above question is 3 to 6 months of expenses should be saved in an emergency fund. Below is a FAQ with things to consider when establishing an emergency fund.

When is it appropriate to save 3 months of expenses vs 6 months of expenses? 3 months may be considered when the following applies:

- A single wage earner who is gainfully employed with a sizable second income such as rental income, alimony income, or trust beneficiary income

- Married but only one spouse is gainfully employed with a sizable second income

- Married and both spouses are gainfully employed.

If the above does not apply then a person or couple should save up to 6 months of expenses. Also, please note gainfully employed may be subjective so consider if the person or couple consistently works full-time hours with a guaranteed salary.

What type of accounts should be used for an emergency fund? An emergency fund should be a liquid asset that can be easily accessed with little to no penalty or fluctuation in principal such as:

- Checking accounts

- Saving accounts

- Money Market (MM) deposit accounts or MM mutual funds

Can a person use their retirement account assets for an emergency fund?

The short answer is possibly but as a retirement expert I do not recommend the use of retirement assets for a person’s first recourse. In review of a prospective client’s portfolio it is prudent a planner review all aspects of a client’s financial situation which may include the review of materials like a person’s Summary Plan Description (SPD) of their employer sponsored retirement plan. The SPD may be used to confirm if there are alternative solutions in case of an emergency like a hardship distribution provision. If a plan has a hardship provision they must follow the IRS guidelines which allow a person to withdrawal assets from their retirement account due to immediate and heavy financial need like to pay for medical expenses, the purchase of a primary residence, tuition, payment to avoid eviction or foreclosure, funeral expenses, and to pay for the damage of primary residence. Using retirement assets in an emergency should be a last resort. Retirement withdrawals prior to age 59.5 may be subject to a 10% early withdrawal penalty, require one to stop deductions for 6 months which impacts retirement asset growth, and the loss of future retirement income. Another retirement plan provision to consider as an option if available in case of an emergency are retirement plan loans. Loans are an administrative nightmare for employers but a feasible option for an employee to prevent a financial catastrophe in the event an emergency fund is not established. The benefit to borrowing from retirement income vs making a withdrawal is that the money will be tax and penalty free provided it is paid back with interest and it will not have a long term impact to the principal.

What expenses should be considered when calculating the emergency fund reserve? Only non-discretionary expenses should be used in this calculation such as:

- Mortgage or rent payment

- Utilities

- Taxes

- Car note

- Insurance

- A modest food and clothing allowance

- Child care

Nonemergency expenses such as streaming subscriptions, cable, gift allowances, dining out, etc should not be factored into the calculation. However, a person may add one additional month of expenses to the emergency fund to cover reoccurring discretionary expenses each month.

In closing, we are encouraged to wear seatbelts to prevent a catastrophe in a car accident. We are required to buy homeowner’s insurance to protect our investment in the event our home is damaged or burglarized. Therefore, an emergency fund is no different than any other preventative mechanism used to mitigate risk and protect ourselves. If you have financial goals but do not have an emergency fund then you are doing something wrong. You are jeopardizing your financial well being. So let’s make establishing an emergency fund a top priority in 2022!

-

Gift Guide to Yourself

Nickels, it has been a long time. I last wrote you in September to share details about my trip to Barbados back in July. However, the holiday season is a upon us and I thought as your self proclaimed satisfied single it would be a good idea to share some gift guide inspiration for gifts to YOURSELF. I have reviewed my credit card statements and amazon purchases over the course of the year to curate a list of some of the best gifts to gift yourself this year. So, let’s get started!

- The first recommendation on my list is a Spa day. Below are links to a few spas I have visited this year and one I plan to visit in the near future.

- Omni Nail Spa in Glenn Mills: I hosted a spa party at this establishment earlier this year to celebrate womanhood with a few of my closest girlfriends. This nail spa has 2 other locations including one in Philadelphia. Their prices are reasonable and they have great customer care which includes one complimentary beverage. Also, they are able to accommodate small private events as well as larger semi-private events during their business hours. I had a semi-private event and was able to bring my own refreshments to set up on their large granite countertop. They were able to accommodate my photo station too! http://www.omnianailspa.com

- Four Seasons Spa in Center City: I had a birthday massage at this spa earlier this year. I enjoyed the massage but most of all I enjoyed the ambiance. Upon completion of my 60 minute spa treatment I was permitted to chill in their relation room for as long as I liked where I was greeted with an assortment of healthy snacks and champaign while overlooking the center city skyline. In addition, the birthday package came with an added service selection, birthday gift, and healing crystals. This gift option is pretty pricey but hey, you have to treat yourself, right?https://www.fourseasons.com/philadelphia/spa/

- Hershey Melt Spa: I visited Hershey for the first time back in October and it was a great weekend getaway in general. There are tons of activities even for a person riding solo like myself. While there I visited the Melt Spa for a Hershey Chocolate body scrub. That was my first ever scrub and I must say it was amazing. It left my skin feeling so smooth and soft. I highly recommend scrubs at least once a year to shed your dead skin. Also, it is an affordable way to enjoy a spa day other than the traditional massage. https://www.meltspa.com

- Sojo Spa in New Jersey: Unfortunately I was unable to make arrangements to visit this spa this year. Every time I was ready to make reservations for this spa something came up but it is definitely on the list for next year. From what I hear this Spa offers a great set of amenities such as pool baths, saunas, lounges, food and a plethora of spa treatments to choose from. Also, from the pictures I have seen there is a beautiful poolside view overlooking the NY city skyline. https://www.sojospaclub.com/explore/

2. My next recommendation are silk pillow cases. I actually gifted the below mentioned pillow cases as favors at the nail spa party I hosted earlier this year and they were a huge hit! As a woman who grew up sleeping in silk scarfs to protect my hair I have quickly learned that silk pillowcases are a game changer for wild sleepers like myself. I usually fall asleep with a scarf and wake up to bed head. However, since using my silk pillowcases I have been able to maintain the healthy shine of my hair, like I said, game changer. These pillow cases are very comfortable and offer a huge health benefit. Below are links to the 2 silk pillow cases I have purchased for myself and others this year.

3. If you are a music lover like myself this next nic pick is for you, Bose audio products! Where do I begin? I was first introduced to Bose audio products in 2018. I was frustrated with purchasing cheap headphones every 2 months so I finally decided to splurge on quality headphones and after tons of research I landed on Bose. It is now 2021 and I still have my very first pair of Bose headphones which at time only cost $49. The value of those Bose headphones have tripled since then but even so, I must say they are worth their value. The aux jack of my first pair of headphones were distorted from being bent into an airplane jack. Also, they have been accidentally washed and the wiring is frayed yet those things are still kicking! I have since purchased Bose Around Ear wireless headphones and a Bose Bluetooth Speaker. The product’s sound is incomparable to any other headsets or speakers I have owned. Also, Bose offers a pretty decent warranty. I find that products backed by good warranties are often quality products. Click Bose to check out their product line and do not be afraid to scurry over to the refurbished products section for some additional cost savings. Their refurbished products are backed by their same standard warranty.

4. I discovered this next pick on a family vlog I follow on YouTube and I thought it was such a unique gift for those who love to entertain or enjoy a nice cocktail every once in a while. It is the Bartesian Premium Cocktail Machine and it is the coolest invention since single serve coffee makers. It is a bit on the pricey side but if you were to calculate the cost of a nice cocktail at a bar or the cost of paying a bartender for an evening of entertainment then you will quickly realize the Bartesian is indeed worth its value. It is the perfect mixologists and is able to make a variety of drinks from a margarita to a Long Island ice tea. Click Bartesian to check it out for yourself.

5. Last but not least give yourself flowers while you are still here or should I say a snake plant OR a dried flower arrangement. Both are low to no maintenance and look very lovely with any home aesthetic. Below are the links to a great dried flower arrangement and a plant.

Comment below if you have any gift suggestions for me.

-

Bae-less in Barbados

My dear Nickels, it’s been a while! I have so much to share but first let’s start with my trip with Barbados! Where do I begin? After 17 months of travel restrictions I finally decided I was comfortable enough to book a flight Internationally. The pandemic really grounded me and if you’ve learned anything about me through this blog you’ve learned I am a jet setter. I am pretty sure I was on a plane at least 25 times or more in 2019. However, the pandemic really invoked some serious fear. Needless to say, when I finally felt up to traveling again I decided to visit Barbados. One of the vlogger families I follow on YouTube had vlogged about their vacation there a few weeks prior and thought, hmm, why not? That was my first mistake, I picked a destination that was not very complimentary for solo travelers. I will get into in a second but first let’s tackle some of the household items.

Departing Flight: I embarked on trip with JetBlue; it was my first time flying with them. The flight was quite comfortable and I would definitely use their services again. I left from the JFK airport in New York because there were no direct flights to Barbados from where I reside. I decided to drive to the airport and park in long term parking. I got a pretty good deal for long term parking too; a much better deal than what you find in my city! My drive to NY was pretty uneventful. I arrived at the airport exactly 3 hours before departure time which is recommended for international flights.

Airport Shenanigans: I’ve only flown out of JFK once before in 2008 when I studied abroad in college. I was not sure what to expect in a post pandemic world but I was quickly acclimated. The airport was crowded, like really crowded! People were shoulder to shoulder and the security lines were obnoxiously long. My bag was flagged at security by an overzealous TSA worker. He pulled out my silk head scarf, my jewelry bag which only had necklaces and 1 bracelet, and my underwear. I am not sure how those items posed a security threat but I had to wait over 30 minutes at TSA for my stuff to be scanned…again. I made it to my gate just in time for boarding.

Barbados Covid requirements: Before booking a trip I was sure to scrutinize the covid rules. I was required to complete an online customs form and provide a negative PCR covid test no more than 3 days prior to my arrival. Additionally, if vaccinated I had to provide proof with a vaccination card. Lastly, all visitors are encouraged to take an approved method of transportation to and from the airport as well as stay at the country’s approved hotels.

Upon arriving at that airport I presented my records. I was asked if my test was self administered or administered by a healthcare professional. I explained it was self administered in front of a healthcare professional at CVS pharmacy. Little did I know that information would deem my test results invalid. I was immediately sent to another line where an orange wrist band was placed on my wrist. Next, I had to complete a covid information form and another covid PCR test. After which I was sent to customs to complete the rest of the process. The entire airport check-in process took about 1.5 hours which was ridiculous!

Hotel: I stayed at the Hilton Barbados Resort. I had read mixed reviews online about the staff and the cleanliness of the hotel but I had a good experience. Immediately upon checking in I was informed my orange wristband meant I would need to quarantine until my second covid test results came back negative. I was restricted to my room and limited to room service. The room service was great but the food was subpar. The room was clean and certified with a lysol sticker as confirmation. I still sanitized all surfaces with my own alcohol wipes. I even brought my own sheets, blanket, shower shoes, and house shoes. I was not taking in chances with covid.

Tour: Finally, the next morning my covid results came back negative. I decided to scour the internet for tours. I managed to find one but by the time I entered my credit card information the tour was sold out. My grandma helped me find an alternative tour but the tour guide called moments later to say that tour was sold out too. That tour guide was gracious enough to suggest another tour company on the island with a similar route, Williamson tours. The tour included a stop at the animal flower cave, a local restaurant, a church, and many different vantage views of the ocean around the island. The tour was pretty anticlimactic but there weren’t many tour options available. Due to covid, most of the more popular attractions had limited capacity or were closed all together. This meant there was not much do while in Barbados. I was unable to schedule a second tour or even book a spa day.

Returning: The taxi ride to the airport was pleasant. It was a much cleaner vehicle than the taxi that picked me up. Once at the airport I made it to my gate with no issues. I flew back with Caribbean airline and let me tell you, that plane was nothing like JetBlue’s plane. The Caribbean airline plane had purple cloth seats and the staff wore medical gowns like we were in a hospital, it was all very weird. The snack or beverage service was suspended though we all were given a bottle of water upon boarding. Needless to say, the 4.5 hour flight was uncomfortable and I would never fly with them again. I eventually made it back to JFK where it took me 4 hours to return to home vs the 2 it took me to arrive at JFK days before. The traffic returning home was horrible!Overall, I would rank my trip to Barbados a 4 out of 10. It was a beautiful destination but a boring place to travel during the pandemic. There are few direct flights from most northeast cities which means expect a long layover or be willing to drive to another airport location. I would not recommend traveling there until covid is under control and they have better airplane routes. Also, I noticed at the time of my visit the island was flooded with couples. I surmise Barbados is a prime bae-cation destination and here it is I thought the state of Virginia was for lovers lol. I was the only single traveler in sight which is unusual. I was glad I decided to experiment with a fake wedding band during this trip. It certainly kept the creeps away. I was only approached by one creep and I was sure to flash my fake ring.

So tell me, where have you traveled during or since the pandemic? Also, let me know in the comments if you are solo traveler and how you feel about traveling with a fake wedding band.