Career & Business Nics

-

MAYbe?

How many of us thought about where we would be if it were not for the global pandemic? Perhaps, you’ve thought about that vacation you would have taken, that place you would have moved, that soulmate you would have met, or that loved one you would have spent more time with. Those years were catastrophic, claiming the lives of over 1M Americans and many more around the globe. However, while we can all agree the pandemic was devastating to many of us, it did allow some of us a chance to capitalize on the opportunities it presented. MAYbe you finally got to work from home like you always wanted. MAYbe you got some much needed downtown with an unexpected layoff. MAYbe you finally started that business. MAYbe you purchased that dream home because of the record low interest rates. MAYbe you took advantage of low cost traveling and finally went on that trip. MAYbe you realized black lives do matter. Either way I would imagine most of us had a philosophical moment during the pandemic when we got to analyze our lives and take stock of what’s important. So today, I wanted to share how my life was redirected due to the pandemic.

I began the new year still trying to recover from a financial hardship from the prior years. On New Year’s day I moved from my luxury apartment in Charlotte to a modest bedroom in a townhouse of my hometown. I moved in with family in hopes of saving enough money to move back to San Diego, a city I had falling in love with when I lived there 2 years prior. A couple of months into my stay the world had abruptly shutdown; my plans were stalled. There was a lot of uncertainty surrounding the state of the economy and spending money to move seemed irresponsible at the time. So I saved but with no goal in mind. In fact, the unanticipated savings seem to have extended to most people around the country. The Federal Reserve recently issued an Economic Well-Being report which it indicated self-reported financial well-being has spiked since 2013 with more than 70 percent of adults confirming they are doing okay or living comfortably financially.

Now that I was able to save along with other Americans I thought about ways to invest my new windfall. I decided to pursue a few passion projects like going back to school. I always had a desire to help people with there finances and following a conversation I had with my mentor I concluded a career as a financial planner would be a great fit for me. I enrolled in an accelerate financial planning program at UCLA Extension in the fall and completed the program that following spring. I paid for the program and corresponding materials out of pocket.

While addressing my career goals I began to ponder my personal goals. I had always joked about having a baby with a sperm donor. Turns out, I was not joking. I wanted to be a mom and I had no prospects or interest in in dating during that time. So, I decided to pursue a path to parenthood on my own. In 2020, I went through my first round of IVF treatment which resulted in 2 pregnancies, 1 miscarriage, and 1 live birth a year in the half later. Welcome to the world, son.

The 3rd passion project I pursued was writing. It had always been a longterm goal of mine to write. I first imagined I would author a book but instead I started a blog where I got to write many short stories. In the first year of my blog I wrote 22 posts chronicling my fertility and financial planning journey. The entire experience has been cathartic. Of course I had high hopes it would be lucrative too but I have not quite figured out how to monetize this passion project.

In conclusion, 2020 was a terrible year with a lot of challenges but if some of us are being honest 2020 redirected the course of our lives in a positive way. If it were not for 2020 I know my life would be totally different. MAYbe I would be living in San Diego. MAYbe I would still be complaining about working in compliance instead of finance like I always wanted (I still complain about that sometimes). MAYbe I would have found satisfaction in just being the cool, single, and childless Auntie. MAYbe we would have a different president. There are a lot of MAYbes but only one reality and I am quite satisfied with my new reality. Comment below and share what your MAYbes were in 2020!

-

Pop Quiz: Are you sure you’re properly insured?!

Nickels, as you may know Real Estate is factored into our net worth (Assets minus liabilities) and many studies have hypothesize that homeownership is one of the surest vehicles to establishing generational wealth. This is because according to my Real Estate class (that I completed but never did anything with) it is a commodity with limited quantity; we cannot make more land. Some of us have already actualized our dreams of homeownership and more recently some of us have already seen a return on our investment considering the value of Real Estate has risen exponentially in most areas over the past decade. So if homeownership is such an important tool towards establishing wealth, wouldn’t one say this is the type of investment we may want to protect? I would say, most of us answered this rhetorical question with a resounding ‘YES’! The best way to protect this precious cornerstone to wealth is to ensure our properties are insured properly.

When considering homeowners insurance one should look at the value of replacement cost which is the cost of rebuilding your home if there was a total loss. Some of the factors considered when insurance companies calculate the replacement cost of a home is location, materials needed to rebuild, labor costs, and the size of the home. These factors are not fixed and can be inflated over a certain period of time. Also, a homeowner should have the correct replacement cost coverage at the time of loss not at the time the policy is established which is why we homeowners should periodically review our insurance policies to ensure we have enough coverage to address replacement cost. Some financial professionals would argue this review should take place every 2-5 years.

Most insurance companies have established a coinsurance provision within their policies to ensure premiums received from the insured are enough to cover claims. Generally, coinsurance requires a home to be insured for at least 80% of the replacement cost but the exact percentage is contingent on your policy. Homes that are not adequately covered will not have their claims fully reimbursed upon a loss. The amount an insurance company may reimburse for homes with a coinsurance policy provision may be determined using the coinsurance penalty formula which is the amount of insurance divided by the amount of insurance required (amount required is the replacement cost multiplied by 80%-100%) multiplied by the cost of the loss (cost of repair) minus the deductible. This formula will give you the value the insurance company may pay for an approved claim and the difference would need to be made up by the insured, hence why it is a considered a penalty. There is so much we should understand about our homeowner’s policy to ensure they work for us when we need them. How well do you understand your homeowner’s insurance policy? Below is a short pop quiz to help you test some of your knowledge. The answers can be found in this month’s nic pick section.

*Addition 4/18/22* Upon calling my own insurance company to confirm that my homeowners insurance is up to date I learned my insurance company, State Farm uses a tool to automatically adjust for replacement cost. Also, I learned about an opportunity to save some money on my auto insurance 🙂

-

Cash(Flow) rules everything around me

Nickels, would you believe there was a time I did not understand how to save to reach my financial goals? I graduated in 2009 with a degree in Finance and had close to nothing in my savings account. Of course my lack of financial resources were partly due to my student loans and the challenges I faced during the recession with securing employment. The other part of my issue was attributed to the fact that I had never really been taught the importance of saving. As I have mentioned before in this blog, I grew up modestly in a low income household being raised by a single mother of 3. Learning to save or having the means to save was not our reality and therefore, it was not a skillset taught in our household. Additionally, college did not really prepare me in this area. I am guessing subjects like saving and budgeting were too rudimentary for a college curriculum. My true lessons about saving were learned in the real world. My good friend who I met at my first corporate job taught me the fundamentals of saving 12 years ago and it changed my life forever. I now want to impart some that knowledge and knowledge I have accrued over years on to you.

Learning to save (as an adult) 101 means first understanding how to create a cashflow statement. A cash flow statement is a record of your inflows (credit) and outflows(debit) transactions. It is used to determine your spending habits and patterns. Also, this statement can be used to make a budget and calculate your emergency fund needs. Below are some things you should keep in mind when preparing your cashflow statement.

- Prepare your cash flow statement for a specific period of time such as a monthly, quarterly, or annual basis. Select a frequency that best works for you so that you can commit to tracking it. In the beginning it may be prudent to monitor your cash flow on a monthly basis to get an idea of your spending habits and to modify your behavior as needed to achieve a surplus.

- Be precise and honest when inputing your data. I know it is easy to guess but the accuracy and effectiveness of the calculations that are supported by the cashflow statement are contingent on correct data. Try not to be tempted to manipulate your figures. If you notice you are in a deficit after completing your statement you can follow up by creating a pro forma cash flow statement. A pro forma statement is used during financial planning process to help clients see their projected inflows and outflows following the implementation of a plan. Theoretically, this version of a cash flow statement should have a surplus or break even. It works like a budget.

- Prepare the cashflow statement at the end of a period. This allows you the ability to reflect on what you’ve actually earned and spent during a particular period. Also, it allows you the ability to reference official documents like paid invoices, bank statements, credit card statements, and paystubs.

- Itemize your statement. This is where you want to be as detailed as possible to ensure you have recorded every expense incurred by category and income received during a specific period. This is important because it will help you address specific areas of opportunity to create a realistic budget and emergency fund at a later time. Traditionally the categories are distinguished by fixed and variable outflows which is an another benefit that will help you create a budget down the line.

- Having a surplus means you have money you can invest.

-

Pregnancy preparedness: Part 3- It’s a Pamper Party

Hey, Nickels! Welcome back to the 3rd installation of my pregnancy preparedness series which is all about self care. I hope you have enjoyed my first two posts Pregnancy preparedness: Financial Readiness and Pregnancy preparedness: What the health?

After learning I was pregnant I became acutely aware that my life was going to change for the better but nonetheless, forever changed. For the past 34 years I had become accustomed to leaning on myself and caring for my needs only. Becoming a parent would be a major shift in priority for me so it was important to me to honor my old self one last time. If there is one thing I am indisputably good at, it is self care. This may be attributed to my virgo nature, or maybe the fact that I am a middle child and had to self sooth, or it could be because I am single with no one to shower me with love and affection so I’ve learned to TREAT MYSELF. To commemorate my last moments of putting myself first I planned a series of events and activities during my pregnancy. Below are a list of things I did as a mom-to-be honor and pamper myself during my pregnancy.

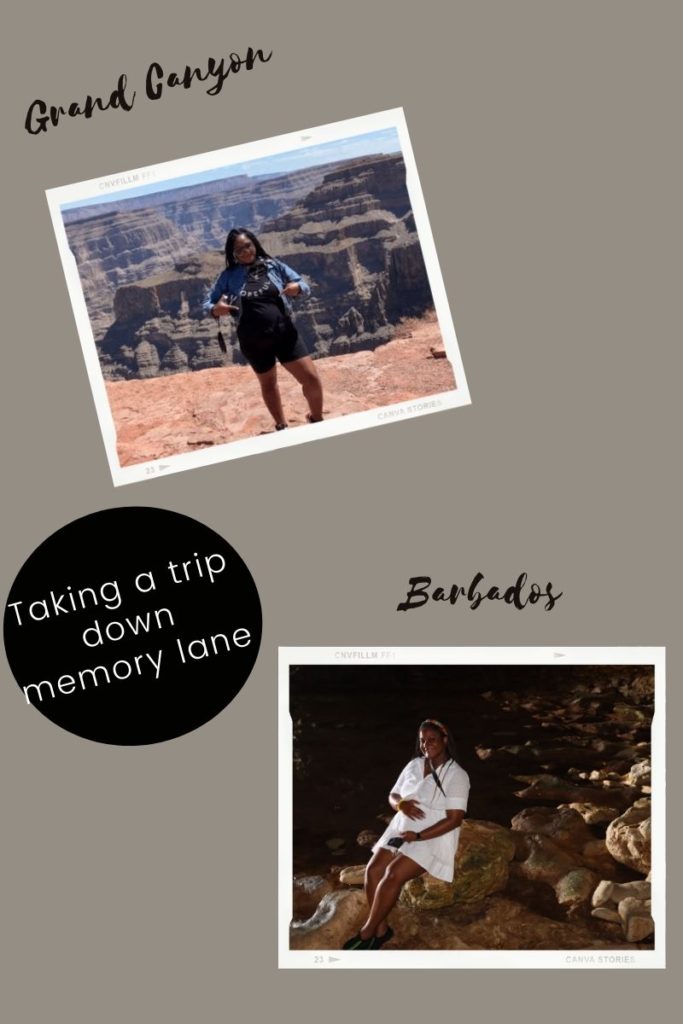

Vacationing: Of course I plan to travel the world with my son and future daughter one day but traveling with children is a lot different than traveling without them. I was a pretty solid traveler before becoming a mom so while pregnant I booked 3 trips. The first trip was an international trip to Barbados. I extended the invite to my best friend but she was unable to accompany me so I booked the trip as a solo traveler (though I was not quite solo given the fetus growing inside of me). Next, I visited the Grand Canyon which was a bucket list destination. I had planned to go on a Grand Canyon trip in 2018 while I lived in California but I moved prematurely and never got to go. I attempted to plan the trip again with one of my besties in 2019 but it got postponed until 2020 then covid hit and the world shut down along with my Grand Canyon plans. The opportunity presented itself again while I was pregnant and I was sure to book my trip without hesitation. In photos you can observe my growing baby bump if you look closely. Finally, I took myself on a baby moon which is defined as a last vacation taken by expectant parent(s) before a baby is born. I went to Hershey for the weekend where I got to make my own chocolate bar and treated myself to my first ever body scrub at the Melt Spa.

Dining out and culinary experiences: I had many culinary experiences while pregnant. I ate at a few nice restaurants that I had wanted to try. I figured higher end restaurants would be off the rotation for a while as a new mom. For instance while in Las Vegas for my Grand Canyon trip I stayed at the new Hilton at Resorts World which has over 40 food and beverage experiences. I tried several of the restaurants while there including the Marigold which is now permanently closed. At the Marigold I ordered the Vegas Lobster Roll which had Santa Barbara sea urchin, American caviar, and dill aioli. It was my first time trying caviar and to be honest had I known there was caviar on the roll I would not have order it. I must say I am happy I tried it because the lobster roll was really tasty yet pricey. Also, for my birthday I took a beach trip with my cousin where we ate at a steakhouse, Prime 13 located in Point Pleasant, NJ. This place served warm soft pretzel in lieu of bread and just wow, it was mouth watering! Also, rather than the mundane caesar salad served at most restaurants this place served a charred grilled romaine lettuce caesar salad and again, just wow! To top it off I ordered a lobster which just melted in my mouth. Another place I dined at while pregnant was Sullivan’s Steakhouse. I would drive by Sullivans while in the KOP area often and always wonder what the food was like so I finally decided to make a reservation. My cousin and I ordered all appetizers. I really enjoyed the Spicy Shrimp Eggrolls. Next, I took a cooking class with my BEST friend, Mo at Sur La Table where I learned to make 3 different types of crepes. Then of course I hit up my favorite lunch spots like Olive Garden and Red Lobster whenever I had the chance. It was not lost on me that I would lose the ability to just jump in the car and go once I became a mom. So I took every opportunity to jump in the car and take myself out.

Spa day and entertainment: Now we all know a spa day is the epitome of pampering oneself so I had to add this to the list. I won’t spend too much time on the subject because I mention my spa experience in detail in last December’s post, Gift Guide to Yourself. Essentially, while pregnant I had a pregnancy massage on my birthday at the Four Seasons Hotel and a body scrub at the Hershey Melt spa during my baby moon. Also while pregnant I hosted a pamper party with a few women from my village at a luxury nail spa. We celebrated womanhood with a nice mani/pedi combo. Again, I mention this experience in my Gift Guide to Yourself blog post. In addition to nice spa days I went to sporting events and museums. For example, my cousin and I went to the 76ers and Utah, Jazz game. The 76ers loss that night but to be fair, the Jazz were ranked 3rd overall in the league at the time so the odds were against the Sixers that night but it was an exciting game. Also, I went to WonderSpaces with my friend. This place is pretty cool, affordable, and offers plenty of great photo opportunities.

Gifts: Since having my son every dime I spend is for him. I honestly do not remember the last time I purchased something for myself. However, while pregnant there were a few purchases I made for myself like my push present. A push present is usually given by a partner to celebrate the milestone of motherhood and to thank the new mom for laboring. The gift is typically jewelry. However, as a single mom there is no partner to celebrate my milestone so I gifted myself a Tiffanys and co necklace with a note to read after labor. I was sure to pack it in my hospital bag. Next, I am obsessed with Chicago style gourmet popcorn so I definitely ordered some Garret mix, Garret’s popcorn and ate it ALL in one night. Lastly, I purchased a Christopher John Rogers dress for my birthday from one of Target’s designer collaboration sales which was a huge hit. I cannot recall ever receiving so many compliments on something I was wearing.

Naps and long showers: Sometimes it is the simple things that make us feel the most pampered. I will never forget my line sister telling me to enjoy taking naps and long showers. I can now confirm those mundane tasks like showering and sleeping are indeed luxuries with a newborn. I am glad I took naps almost EVERY lunch hour while pregnant (which I did before pregnancy too, I am napper) and relished in long showers. I rarely get to take naps now and my showers are short.

Professional development: I had always desired a career in Finance particularly helping people plan for their future so I did a lot of research to determine the best career move for myself and personal financial planning came to mind. I had started an accelerated Personal Financial Planning (PFP) program before I got pregnant but completed my program in my second trimester. It was the first step of many to begin my career as a planner and to help my family build wealth. The successful completion of the program while pregnant was so gratifying given how challenging the courses were. My professors did not think I would be able to keep with the other professionals in the class because I was the only person who was not already an agent or advisor in my cohort. As such completing the program and sometimes outperforming my classmates was an added bonuses. Upon completion of my PFP certificate I began an entrepreneur certificate program and started studying for the big exam. Some people may not consider professional development pampering but I think anything that makes me feel good is considered pampering.

Comment below and share with me how you like to pamper yourself. Do you take yourself on trips, out to eat, or treat yourself to pedicures too?

-

Pregnancy Preparedness: Part 1- Financial Readiness

The moment I decided that I was ready to be a parent I knew it was time to ensure my personal finances were in order. It helped that I was already enrolled in my accelerated Personal Financial Planning program at UCLA during the time of my IVF. The program kept me educated and motivated while I administered shots to abdomen each night. Below are some of the steps I took to prepare for my son.

First, I evaluated life insurance:

I happened to be enrolled in my insurance planning class at the time I decided to evaluate my life insurance coverage. Our professor, who has retired was a renowned CFP and Insurance agent in California, shout out to Linda! We literally reviewed every type of insurance there is, Disability; Life; Auto; Homeowners; Health; Long term care; Annuities; and Social Security. As a prospective planner I knew the first thing I needed to do when evaluating my life insurance needs was determine if I had any shortfall in my current coverage and there are three common calculations available to do just that. I used the multiple of salary method which is the fastest and least precise option to get a ballpark figure of what I was looking for before calling an insurance agent.

Calculation Option- Multiple of Salary Method

This method simply takes the salary of the wage earner and multiples it times the number of years the family will be able to continue as they are now in the event of the wage earner’s death. This is the least complex calculation and should really only be used to get a quick estimate. The other calculation options are the Human Life Value Method which is more precise and Personalized Needs Approach which is the most precise.Once I understood how much of a benefit I needed it was time to select a provider. I did this by confirming the credit rating and financial strength of the policy provider that I wanted to use. Then, I determined the type of policy I wanted. I started with a termed life policy which would cover my current liabilities and would extend until my son is the age of majority. Also, I added a smaller whole life policy which would accumulate a cash value. This policy would be used to cover my funeral and final expenses. Finally, I added a third policy to offer a cushion to my son’s guardian to assist with childcare expenses.

Please note, it is okay to consider your employer’s group life insurance policy when evaluating your life insurance needs. Some agents will insist that an employer’s group life policy is inconsequential but everyone’s financial circumstances varies. A planner understands that one size does not always fit all and would consider all avenues when preparing a comprehensive plan.

Next, I evaluated health insurance:

When embarking on the path to parenthood it was prudent for me to understand my health insurance benefits as I would be using them quite a bit for reoccurring doctor appointments, ultrasounds, labor and delivery. I first did an independent visual review where I analyzed my deductible and maximum out of pocket cost for the year. In understanding these cost I was able to save a reserve over my 41 week pregnancy (yes, I had a late term baby lol) to cover my medical expenses. My due date was 1/2 so I desperately wanted to have a 2021 baby as I had already paid my maximum out of pocket expenses for the year but my son had different plans; I was prepared to adapt. Next, I decided to call my providers (I was in between 2 providers in 2021) to better understand my policy’s offering. It was through these calls that I learned I would be eligible to receive a FREE BREAST PUMP! Yes, that’s right I was able to order a free electronic breast pump through my health insurance provider. I was given many options to choose from too which included the most advanced pumps on the market.

Now, it was time to Prepare an Estate plan:

With both of my employers in 2021 I opted into a group legal plan policy during open enrollment in preparation for my son’s arrival. I was sold on this legal service once I realized they offered estate planning services with my coverage. I pay approximately $9 bi-weekly for this plan and from what I understand about attorney fees, this service is a fraction of the premium I would have paid hiring an attorney on my own. My service provider’s website can populate a pretty robust estate plan in 15 minutes following the completion of a brief questionnaire. Below are the materials included in my estate plan:

- Last Will and Testament (in the event I die)

- Advance Healthcare Directive aka Living Will (in the event I am incapacitated and need someone to make health decisions)

- Durable Power of Attorney (in the event I am incapacitated and need someone to make financial decisions) and,

- Revocable Living Trust for my property

The above documents had to be notarized with 2 witness who were unrelated to me and not included in the directives. You can find a FREE notary at your local bank branch, which is what I did or local councilman’s office.

Finally, I established an emergency fund:

Here is the link to my blog post about establishing an emergency fund,

-

In Case of Emergency

Nickels, do you have an emergency fund? This is a topic that is near and dear to my heart based on my own financial hardships and experiences. You may recall during our current VP’s run for the presidency in 2019 her mention of how most Americans were only a $500 emergency away from a complete financial catastrophe which is why this topic is so important. As a person who has studied Personal Financial Planning and has a degree in Finance I have observed that most people when discussing financial literacy or generational wealth glaze over how essential an emergency fund can be to a person’s overall financial wellness. I think most of us put the cart before the horse on this particular topic of financial planning. In class we were taught that a sufficient emergency fund is a top priority to establish with most clients before helping them assess their other financial goals because without this component their other financial goals such as retirement, insurance, and investing can be compromised.

So you may be wondering what a sufficient emergency fund is, right? Well that may vary from person to person as the rules may be applied differently based on a person’s financial well being. For example an extremely wealthy person like Elon Musk is less likely to have or need an emergency fund solely based on the characteristics of an emergency fund which are savings placed in cash or cash equivalents; not many wealthy people or savvy investors will tie up their assets in such low interest generating accounts. However, the average American needs such a fund and without curating a custom analysis on an individual which would include preparing a statement of financial positions to determine a person’s net worth and a cash flow statement to understand a person’s spending habits and non-discretionary expenses, the general answer to the above question is 3 to 6 months of expenses should be saved in an emergency fund. Below is a FAQ with things to consider when establishing an emergency fund.

When is it appropriate to save 3 months of expenses vs 6 months of expenses? 3 months may be considered when the following applies:

- A single wage earner who is gainfully employed with a sizable second income such as rental income, alimony income, or trust beneficiary income

- Married but only one spouse is gainfully employed with a sizable second income

- Married and both spouses are gainfully employed.

If the above does not apply then a person or couple should save up to 6 months of expenses. Also, please note gainfully employed may be subjective so consider if the person or couple consistently works full-time hours with a guaranteed salary.

What type of accounts should be used for an emergency fund? An emergency fund should be a liquid asset that can be easily accessed with little to no penalty or fluctuation in principal such as:

- Checking accounts

- Saving accounts

- Money Market (MM) deposit accounts or MM mutual funds

Can a person use their retirement account assets for an emergency fund?

The short answer is possibly but as a retirement expert I do not recommend the use of retirement assets for a person’s first recourse. In review of a prospective client’s portfolio it is prudent a planner review all aspects of a client’s financial situation which may include the review of materials like a person’s Summary Plan Description (SPD) of their employer sponsored retirement plan. The SPD may be used to confirm if there are alternative solutions in case of an emergency like a hardship distribution provision. If a plan has a hardship provision they must follow the IRS guidelines which allow a person to withdrawal assets from their retirement account due to immediate and heavy financial need like to pay for medical expenses, the purchase of a primary residence, tuition, payment to avoid eviction or foreclosure, funeral expenses, and to pay for the damage of primary residence. Using retirement assets in an emergency should be a last resort. Retirement withdrawals prior to age 59.5 may be subject to a 10% early withdrawal penalty, require one to stop deductions for 6 months which impacts retirement asset growth, and the loss of future retirement income. Another retirement plan provision to consider as an option if available in case of an emergency are retirement plan loans. Loans are an administrative nightmare for employers but a feasible option for an employee to prevent a financial catastrophe in the event an emergency fund is not established. The benefit to borrowing from retirement income vs making a withdrawal is that the money will be tax and penalty free provided it is paid back with interest and it will not have a long term impact to the principal.

What expenses should be considered when calculating the emergency fund reserve? Only non-discretionary expenses should be used in this calculation such as:

- Mortgage or rent payment

- Utilities

- Taxes

- Car note

- Insurance

- A modest food and clothing allowance

- Child care

Nonemergency expenses such as streaming subscriptions, cable, gift allowances, dining out, etc should not be factored into the calculation. However, a person may add one additional month of expenses to the emergency fund to cover reoccurring discretionary expenses each month.

In closing, we are encouraged to wear seatbelts to prevent a catastrophe in a car accident. We are required to buy homeowner’s insurance to protect our investment in the event our home is damaged or burglarized. Therefore, an emergency fund is no different than any other preventative mechanism used to mitigate risk and protect ourselves. If you have financial goals but do not have an emergency fund then you are doing something wrong. You are jeopardizing your financial well being. So let’s make establishing an emergency fund a top priority in 2022!

-

The Art of Negotiation

Hi Nickels! It has been a while, I know. A lot has happened since we last caught up. This week in particular has been quite eventful. My employer sold their entire retirement division and as a result I was terminated but offered employment with a new company.

I have been trying to make my mark in the financial industry for over a decade and there have been many impediments such as graduating during a recession, lack of sponsorship and diversity in corporations, and my failed attempts to get into a graduate program of my choice. It has been a wild ride but for some reason I have continued to stay on this path to nowhere despite its many challenges. In 2019, I finally landed a role with my dream employer who has an astounding reputation in the financial industry. I felt hopeful about my future in Finance for the first time since graduating college. However, that all changed after a 30 minute conference call on Tuesday. That’s right, in 30 minutes a decade worth of struggle, triumph, pivots, and plans were all derailed once again. I am still somewhat hopeful as I have decided to pursue my CFP designation in 2020 and recently finished my coursework. I am now eligible to sit for the board exam and accumulate work experience. The road to my designation is long but I believe will be worth it. In the near future I will finally have more control over my career path. Needless to say, the events this week have inspired today’s topic, the art of negotiation. Below are some tips I have learned along the way that may help you or someone you know.

Nic #1: Do not overvalue benefits and bonuses when negotiating the terms of your salary.

I recall my older and wiser cousin encouraging me to error on the side of caution when considering the other benefit offerings during a salary negotiation. Bonuses are not guaranteed income and benefits such health insurance, profit sharing contributions, or match formulas are subject to change. I am so glad I listened to my cousin because when the Merger & Acquisition happened this week my benefits were drastically changed and the future of my bonus is uncertain. It gave me some peace of mind knowing I did not settle on substituting my salary with bonuses and benefits.

Nic #2: You can negotiate more than your salary

It is not all about the money! I know, that sounds crazy lol. Well, it is mostly about the money because you have to be able to support yourself and your family. However, do not be shallow during negotiation time. Think about other opportunities you would like. For me, when I left my prior employer I knew I would be forfeiting much needed vacation time so during negotiations with my new employer I asked for vacation time. I only asked for a few days but I was so happy I made the request. It was not long after I was hired that we endured a global pandemic and were placed on travel restrictions. Before then I was able to utilize the time I had requested during negotiation to take 2 much needed vacations.

Nic #3: You do not have to wait to receive a new employment opportunity to negotiate

I like to keep an annual log of my accomplishments and values adds to a position. I learned this technique from a mentor with my prior employer. Also, I like to be mindful of my value season which is a time of year where my value at a company is exponentially higher than any other time during the year. In my industry, this season is the first quarter. Knowing these two things I am able to narrow down a time of the year I may have the most success with negotiating a change in my position, schedule, or salary.

Nic #4: Do not be afraid to ask and do not be afraid to walk away.

The art of negotiation was not taught in college. I did not realize it was a skill I needed to know until I was well into my career. Once I caught wind of this wondrous art form I worked to hone the skill. My first attempt at negotiating was unsuccessful. I highlighted my positive attributes, endorsed my skills, and explained how I would bring value to my new role to no avail. I requested a de-minis raise and to put it into perspective, I only requested an extra, $1500 a year. That’s right, I only wanted an extra $57 a paycheck. My request was denied. In fact, the recruiter made a point to share with me that the department’s head approved my request but that the organization was denying my raise. Furthermore, I was encouraged to work overtime if I wanted to make more money. In hindsight I should have used my common sense and walked away from the position. At the time I was young and naive. I quickly learned the power of negotiation depends on one’s ability to walk away from an unfair deal.

Not too long after I reluctantly accepted the role, a white male colleague from my previous department asked me about the process as he was anxious to change roles too. I shared my experience and warned about the negotiation process. A few months later my white male colleague was hired by another department. He shared his experience with me and bragged about successfully negotiating a new salary. I now ask myself ‘what would a white man do?’ lol. Never again will I walk away from a negotiation table empty handed.

Nic #5: Do your research

I think this is where it is important to know your value and to stay up to date with your industry’s trends. I like to stay in communication with recruiters to have a pulse on the job market. My motto is always be prepared. I always have an idea of what my salary should be and what others companies would pay someone with my skillset. This allows me to prudently negotiate my salary when the time comes without insulting the recruiter or undercutting myself. Use tools like Glassdoors to monitor your salary range and LinkedIn to build rapport with recruiters in your field or fields you are interested in. This will keep you on your toes as opportunities open up.

-

Number One vs The Only One

As a byproduct of 2 thriving marginalized communities in the education systems I became acutely aware of racism and sexism upon entering the workforce. Allow me to elaborate.

I attended a single sex, all girls high school where I excelled socially and academically. My school was a part of a very small community of special acceptance public schools in the inner-city that offered a rigorous program only consisting of rapid, star, or advanced placement classes. Our regular curriculum and extra curricular activities included foreign languages, music (I took a piano class), ceramics, dance, and theater. In addition, we were required to take the PSATs every year and provided with free SAT prep courses. Essentially, the objective was for us to compete and perform academically on a collegiate level. In fact, there was an annual contest held where classes were encouraged to compete in athletic and academic challenges. My class won all 4 years, shout out to the class of 249!

Also, in high school I served in a myriad of elected leadership positions in student government, participated on a dance team, and volunteered as the girl’s varsity team’s statistician. All while carrying a full course load that include not one but two math and science courses. We were never made to feel inadequate because we were female. We were taught to carry the attitude of champions. Our teacher’s were expected to challenged us in ways to inspire critical and independent thinking as well as creativity. I attribute some of my strong will as a female in male dominated spaces to the school’s unwavering belief in our ability to perform at the highest levels regardless of our gender.

Following high school I decided to attend a historically black university. I was accepted into predominantly white institutions but I felt compelled to attend a HBCU after participating in a college tour during the spring break of my sophomore year. In college I was recognized for my leadership and academic achievements too. I had been awarded a full tuition scholarship for all four years and I was the recipient of the Governor’s scholarship my junior year. Additionally, I served as the Business Club President, Treasurer of my class, Student Leader Ambassador, and Algebra Tutor and Counselor for the Upward Bound program. Simply, I excelled as a student, though my social life was a bit of a reck. The introduction of men back into my space was a distraction. I definitely see the benefits of single sex schooling but that is a different conversation.

It is my contention both schools shielded me from the injustices I would later experience in the real world. Both schools offered a competitive environment for me to blossom free of adversity.

It was not until I entered the workforce that my intellectual and leadership capabilities were questioned. I was confused considering my background and eduction history. The only variable between school and work was the change in the leadership construct. The leadership team in my first corporate job was almost exclusively made up of white males. Again, this power dynamic made me acutely aware of sexism and racism even if it was covert and unintentional. As a black woman I believe I was often perceived as inferior in work environments. Again, this revelation was bewildering. I will admit both my high school and college made attempts to prepare me for this type of discrimination but they both fell short. In high school we were taught to compete intellectually but unfortunately race was overlooked. Whereas, in college we were taught about the African American experience but not the gender experience. So when I was thrusted into the working world where my gender and race mattered and not in a good way, I did not fair well. To be fair there was definitely an effort to be more inclusive of women in leadership but those women rarely were women of color. It was blatantly obvious that corporate leadership lacked racial diversity. Suddenly, I was not competing to be number one anymore. I was competing to at least be the only one in the room who looked like me.

It was an unspoken and unwritten understanding that depending on the prestige of a position there could only be one or maybe two diversity hires. Furthermore, if a black woman did somehow manage to successfully score a leadership role, it seemed her qualifications were scrutinized to a higher degree. An example of this scrutiny would be what I experienced while working for a prior employer. At this job a black female was announced as the first black and first female district manager in that county’s history. It was a monumental accomplishment minimized by a few insecure men on the job. Before meeting her, I had heard many unpleasant rumors about her competencies and sexual favors performed for the role; it was deplorable. Apparently we women can only screw our way to the top. Finally before leaving the company I had the opportunity to meet this historic woman for myself. She was very much competent and capable of her job. Plus she advocated for other black women.

Another issue I experienced in corporate was the the gender and race pay gap! My former male counterparts frequently and obnoxiously discussed their salaries on the floor. So it did not take much effort on my end to learn I was being compensated much less for performing the same job. It is a very toxic culture but thankfully it is changing. In closing, I am grateful for my high school and college experiences. These institutions protected me from during my most formidable and impressionable years. They allowed me to thrive in environments conducive to growth and absent of discrimination. I had been beaten but not broken in corporate America as a result of my education.

-

It’s not complex, it’s a duplex

Hey Nickels, if you are a single woman do yourself a favor and purchase an income producing property. I lived with my parent until I was 27 because I wanted my first place on my own to be mine. As a single woman without children, I did not need a huge space nor did I want to commit to a forever home. This required me to be forward thinking with the type of property I wanted to acquire. I purchased a duplex because it secured my uncertain future by creating an initial situation where I could live in an owner occupied property and get a 50% tax benefit. Also, as a single person, I had the added security of not living alone and therefore, discouraging crime. I figured when the time came and the duplex no longer suited my growing family’s needs, I could move and still maintain a source of passive income plus receive 100% of the tax benefit.

I never got married but I did have the opportunity to move with my job. My former employer had acquired offices around the country and as such, opened the opportunity for me to work remote out of those various locations. It was an amazing explorative experience and it opened up many other opportunities. However, living in different geographic locations meant having different cost of living requirements. Luckily, I was able to rent both units of my property to help finance my standard lifestyle. While my prior employer was generous with their flexibility to allow me to work remote, I did not receive a cost of living adjustment. Therefore, the additional passive income from my rental property helped subsidize my living expenses beyond my W-2 wages.

Investment properties are great income resources for single people but a huge responsibility! Below are some nic tips to consider if renting a property.

Nic#1: Be sure to familiarize yourself with the rental compliance requirements in your state and municipality. You may want to do this step before considering purchasing an investment property as it may dictate where you decide to buy or if you decide to buy. There are certain cities where tenant rights are disproportionately favored and the rental compliance can be more restrictive. Also, anytime you are dealing with human rights which housing laws are the legalities can become convoluted. In some metropolitan areas you must obtain and maintain a rental license, provide fair housing information, pay trash collection fees, comply with maintenance schedules and standards, partner with utility companies to mitigate the risk of a lien due to tenant delinquencies, and much more. This can be a lot to manage.

Nic#2: If the responsibilities of tenant management sounds overwhelming, this is not a deal breaker for your investment opportunity. You may want to consider hiring a property manager. This is one of the consultation services, 828 A.M. LLC can offer. Please subscribe to contact me and learn more. A property manager can help you screen tenants, coordinate repair projects, record keep expenses, assist with eviction proceedings, and maintain the aesthetics of the property. It is important these professionals are screened. I have had a few horror stories with property managers but I will spare you the details in this post.

Nic#3: ALWAYS screen your tenants. An income producing property can quickly become a money pit with the wrong occupant. Screening should include a state criminal background check, income verification, personal referral(s), credit check, and a judgment check. My suggestion is if you find a judgement on a prospects record during the screening process, immediately reject the applicant. Speaking from experience no landlord wants to evict a tenant. It is a very costly and time consuming process that you only do if you were left with no other option but to mediate inside the courtroom. So if a former landlord went through the trouble to file for the legal proceeding, the situation had become severe. Spare yourself the headache and move forward with another applicant. All other subject matters that may come up during the screening process are negotiable in my opinion.

Nic#4: ALWAYS check the public zoning records to ensure the income property is properly zoned for its use. So many Jack of all trades convert their homes without the proper permits. Do not buy a income producing property without checking the zoning. You can sometimes rezone if the property was converted without prior authorization but be sure to consider that expense during settlement negotiations. I have personal experience with zoning and as such, 828 A.M. LLC is happy to assist you with the necessary paperwork to rezone your property for proper use. Do not illegally operate your property as a business. It will come back to haunt you if you ever need to evict or file any other legal proceeding.

Nic#5: Ensure your homeowners insurance is updated accordingly. The benefit of an owner occupied property is that most insurance companies will give you the homeowner rates which are much lower than the investment property rates. However, if you ever relocate be sure you convert your homeowners insurance to ensure you have proper liability coverage. Also, ALWAYS require your tenants carry their own renter’s insurance as the owner’s insurance does not cover the personal property of a tenant. Renter’s insurance should be an added line on your leasing agreement.

Nic #6: Create a comprehensive leasing agreement. I like to pair my leasing documents with a bed bug addendum, house rules, and a walk through checklists. If you are a Pennsylvanian, please subscribe to contact us at 828 A.M. LLC to receive copies of our PA compliant templates which can be customized to your specifications.

Nic#7: If your property is being financed by a financial institution or investor be sure to check the clauses of your document to understand the restrictions of use. Non authorized use of a financed property could result in the default of your loan. Also, if you live in a HOA community be sure to check their rules as it relates to rentals as well. Some HOA permit long-term renting but not short-term renting like an Air bnb. Essentially, always do your due diligence to determine how a property can be used so you can make the right decision that fits your needs. Unless you are a flipper, you do not want to be stuck with a property you cannot use.

Nic#8: Be sure to manage your money properly. Create a separate bank account to collect rent and keep tenant deposits. Do not co-mingle a tenant’s deposit with your personal assets. Also, always keep an emergency fund for repairs and maintenance issues that WILL come up without warning. Unlike repairs for a personal use residence you must tend to tenant issues within a reasonable timeframe.

In summary, singles and others just looking for a long term investment opportunity may consider buying an income producing property. Check with your local agents to review the inventory if you are in the market for a new home.

-

Are you kiddie taxing me?

Hi Nickels, as you may know I have 10+ years of financial services and compliance experience. Additionally, I am in school to become a licensed financial professional. My primary objective will be to help my prospective clients accumulate and manage wealth. My other objective will be to support initiatives to increase financial literacy in underserved communities. This platform is a great resource to carry out such fundamental tasks, beginning with today’s Nic inspired by the 2020 tax season.

Nic #1: Consider hiring help. It is that time of year again and tax season is full swing. We have until that sacred deadline date, April 15th (without extension) to file our personal tax returns. Most financial stewards would agree taxes can be one of the largest impediments to wealth accumulation. Therefore, it is beneficial to gain a basic understanding of the Internal Revenue Codes that govern our tax laws; and to consider hiring a recognized representative to help you navigate more complex tax strategies. An Attorney, Certified Public Accountant (CPA), or Enrolled Agent (EA) are all recognized representatives before the IRS and may defend you in the event of an audit. It may be worth the investment to hire these professionals if your tax circumstances were more nuanced in 2020.

Nic #2: Be sure you understand what income is taxable. Dub 20 has curated a myriad of black entrepreneurs and a public campaign to invest in black owned businesses. I surmise even more business owners will blossom in 2021. As a result of the influx in ownership within our community many of you may be thinking about legacy and generational wealth. This may include ideas like purchasing stocks and opening savings accounts for your offspring, right? If so. parents should ask their tax preparer about kiddie tax and how it may impact your child. Kiddie tax is a tax applied to children under age 19 (age 24 if student) on unearned income. Unearned income includes saving accounts or dividends.

Nic #3: Be sure you understand your tax deductions. In 2020 the kiddie tax is applied at the kid’s tax rate on unearned income over $1100 but under $2200. Amounts over $2200 are taxed at a less favorable rate, the parent’s tax rate. Please note the first $1100 is tax free due to the standard deduction. Speak to a tax advisor if you are unsure which deductions apply to your circumstances in 2020. Remember proper tax avoidance is legal and used by savvy tax strategist to help you lessen your tax liability whereas tax evasion is illegal.

Leave a comment below to let me know how you are preparing for the 2020 tax season?